Published January 16, 2015.

The complete ‘big HP spreadsheet’ can be built by pasting in the columns, one at a time. I can’t promise that it’s easy, or that the spreadsheet is accurate. If you use much of the spreadsheet in a published piece, please give fair credit to ‘sinksmith’ with the link https://kitchensinkinvestor.wordpress.com/more/articles/articles-2015/build-big-hp-spread/ or if that’s too long, https://kitchensinkinvestor.wordpress.com/index/ . Obviously I have no copyright on my source, the 10-Ks filed with the SEC.

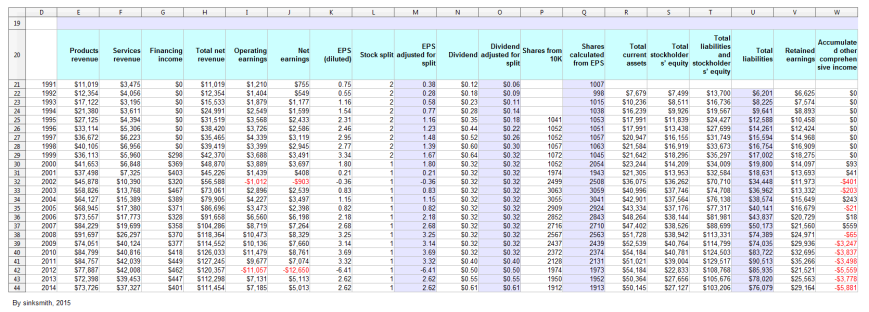

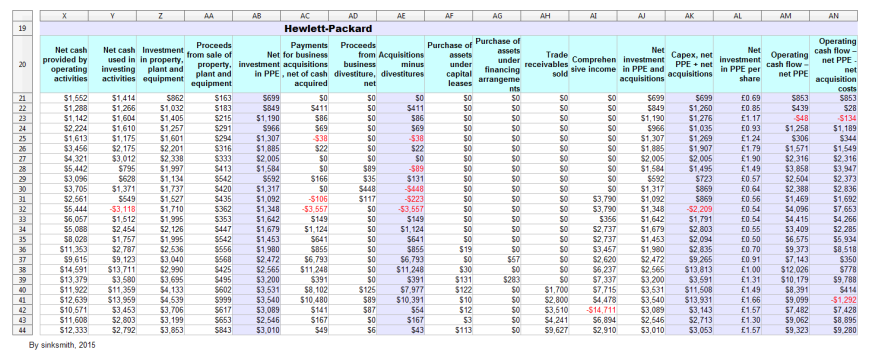

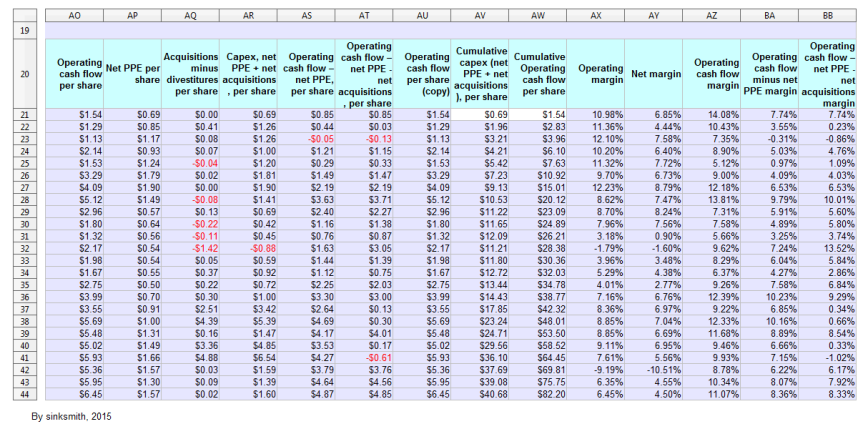

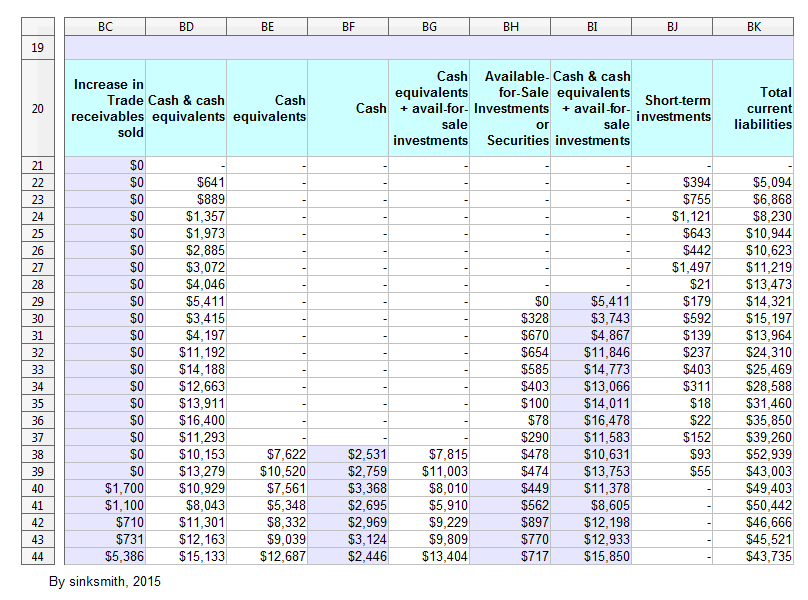

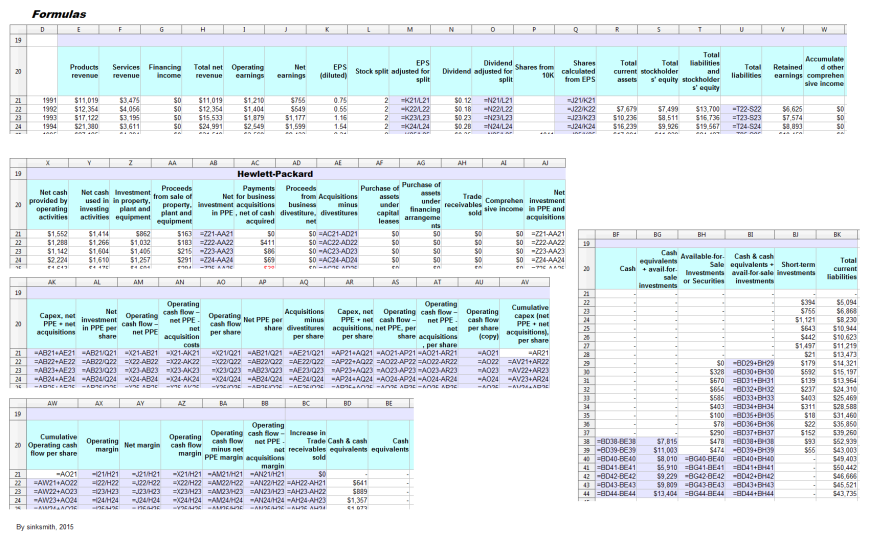

First, I show the spreadsheet in 4 sections:

—————————————————————————————————————

Next I show the formula view. Columns which hold data and not formulas won’t look much different:

—————————————————————————————————————

If you only want the data columns, you can choose to use only the data columns you want, and place them wherever you like (but you won’t be able to use my formulas).

In the columns after “This is the data” … (below), each column has:

1) a cell address

2) an indication of the format you need to apply

3) a column header like “Products revenue”, “Services revenue” etc. (except for the years in the first column)

4) either column data or a formula, or in some cases a mixture of both.

The first column is the years 1991 to 2014. The first five lines are:

D21

num

1991

1992

1993

“D21” is the cell address, which will have “1991” pasted into it. The format code “num” means numeric format. If you paste in the ‘year’ column and it doesn’t look right, set the format to ordinary numbers (not dates) with no decimal places (and no decimal point).

All the other columns start at row 20, with a heading at the top.

The formats are:

$ – currency, with no decimal point

$.cc – currency, dollars-and-cents format as in $1.23

% – percentages

num – numeric, with no decimal point (for the year and numbers of shares)

Obviously you don’t apply those to the column headings, which you can put in any format you like.

If you have problems pasting-in the numbers, try copying the column data into a basic text editor like Microsoft Notepad (with Word Wrap turned off, in the Format menu). The problem might be codes that you don’t see in the browser but which are picked up when you copy. Pasting into Notepad will either drop the unwanted codes, or make them visible in Notepad so you can delete them.

I tested these instructions and was able to copy from the Firefox browser and use the normal ‘Ctrl_v’ paste, but if you have problems you could try right-clicking to get ‘Paste Special’ and choose ‘Unformatted text’ (if the text is already unformatted, the option won’t be shown). I also checked that the 2014 figures were the same in my built-from-here version as in my original spreadsheet.

Some balance sheet quantities have no entry for 1991, which I represent by a blank line. The first of these is column R, where I have –

R20

$

Total current assets

7679

10236

16239

(etc.)

Make sure that “7679” is in R22 (row 22 is for 1992) and paste the heading and the figures seperately if necessary to get the blank cell below the heading.

Column P20 is “Shares from 10K”. It starts with four zeros, which ought to be blank, but WordPress ignores consecutive returns (I’m using their free version). The ten years of zero Comprehensive income in column AI are a case where zeros should be interpreted as ‘no data’. If you choose to delete all consecutive zeros that start in 1991, the columns affected will accurately imply ‘no data’, but it may affect some calculations.

Column M is the first with a formula (rather than data) –

M20

$.cc

EPS adjusted for split

=K21/L21

=K22/L22

I give the first two formulas, but in most cases you should only need the first, and then be able to extend down (the second formula will let you check that extending down has worked properly).

There are exceptions. Two are for cumulative data where the first line starts the total and subsequent lines update the total. Another exception is a column to calculate an increase over the previous year. In those cases I give three lines, as here:

AV20

$.cc

Cumulative capex (net PPE + net acquisitions), per share

=AR21

=AV21+AR22

=AV22+AR23

In column BF (Cash), there’s no data for the formula until row 38 (for 2008), so there’s a code for the heading (“Cash”, on row 20) followed by the code for the formula, like this:

BF20

Cash

BF38

$

=BD38-BE38

=BD39-BE39

In columns BH and BI, the formulas also don’t start at or near the top. I’ve put every formula in, so you just need to copy and paste the whole column (without needing to extend the formula down).

Finish by adding a note that amounts are in millions except for per-share data, add an overall heading if you like, and format the headings, add tinted backgrounds etc. as you like.

A tip for overseas readers – I use OpenOffice Calc (it’s free), and by default I get the ‘£’ currency symbol, not ‘$’. I have not found a way to change the default currency for a document, and I have to use Format Cells. If you have the same problem, in the ‘Format Cells’ dialog, set the language to ‘English (USA)’ under ‘Language’ BEFORE choosing ‘Currency’. Then, when ‘Currency’ is selected, you should automatically get ‘USD $ English (USA) under ‘Format’. Otherwise, you have to select that option from near the end of a very long list. (An alternative is to leave the formatting until everything is entered, then Select All, Format Cells, and in the dialog, set the language to ‘English (USA)’ under ‘Language’, and then format individual columns or blocks of them.)

This is the data, with the top cell address of each column and the format codes (which you don’t paste in) in bold italic –

D21

num

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

E20

$

Products revenue

11019

12354

17122

21380

27125

33114

36672

40105

36113

41653

37498

45878

58826

64127

68945

73557

84229

91697

74051

84799

84757

77887

72398

73726

F20

$

Services revenue

3475

4056

3195

3611

4394

5306

6223

6956

5960

6848

7325

10390

13768

15389

17380

17773

19699

26297

40124

40816

42039

42008

39453

37327

G20

$

Financing income

0

0

0

0

0

0

0

0

298

369

403

320

467

389

371

328

358

370

377

418

449

462

447

401

H20

$

Total net revenue

11019

12354

15533

24991

31519

38420

35465

39419

42370

48870

45226

56588

73061

79905

86696

91658

104286

118364

114552

126033

127245

120357

112298

111454

I20

$

Operating earnings

1210

1404

1879

2549

3568

3726

4339

3399

3688

3889

1439

-1012

2896

4227

3473

6560

8719

10473

10136

11479

9677

-11057

7131

7185

J20

$

Net earnings

755

549

1177

1599

2433

2586

3119

2945

3491

3697

408

-903

2539

3497

2398

6198

7264

8329

7660

8761

7074

-12650

5113

5013

K20

$.cc

EPS (diluted)

0.75

0.55

1.16

1.54

2.31

2.46

2.95

2.77

3.34

1.80

0.21

-0.36

0.83

1.15

0.82

2.18

2.68

3.25

3.14

3.69

3.32

-6.41

2.62

2.62

L20

num

Stock split

2

2

2

2

2

2

2

2

2

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

M20

$.cc

EPS adjusted for split

=K21/L21

=K22/L22

N20

$.cc

Dividend

0.12

0.18

0.23

0.28

0.35

0.44

0.52

0.60

0.64

0.32

0.32

0.32

0.32

0.32

0.32

0.32

0.32

0.32

0.32

0.32

0.40

0.50

0.55

0.61

O20

$.cc

Dividend adjusted for split

=N21/L21

=N22/L22

P20

num

Shares from 10K

0

0

0

0

1041

1052

1052

1057

1072

1052

1974

2499

3063

3055

2909

2852

2716

2567

2437

2372

2128

1974

1950

1912

Q20

num

Shares calculated from EPS

=J21/K21

=J22/K22

R20

$

Total current assets

7679

10236

16239

17991

17991

20947

21584

21642

23244

21305

36075

40996

42901

43334

48264

47402

51728

52539

54184

51021

54184

50364

50145

S20

$

Total stockholders’ equity

7499

8511

9926

11839

13438

16155

16919

18295

14209

13953

36262

37746

37564

37176

38144

38526

38942

40764

40781

39004

22833

27656

27127

T20

$

Total liabilities and stockholders’ equity

13700

16736

19567

24427

27699

31749

33673

35297

34009

32584

70710

74708

76138

77317

81981

88699

113331

114799

124503

129517

108768

105676

103206

U20

$

Total liabilities

=T22-S22

=T23-S23

V20

$

Retained earnings

6625

7574

8893

10458

12424

14968

16909

18275

14097

13693

11973

13332

15649

16679

20729

21560

24971

29936

32695

35266

21521

25563

29164

W20

$

Accumulated other comprehensive income

0

0

0

0

0

0

0

0

93

41

-401

-203

243

-21

18

559

-65

-3247

-3837

-3498

-5559

-3778

-5881

X20

$

Net cash provided by operating activities

1552

1288

1142

2224

1613

3456

4321

5442

3096

3705

2561

5444

6057

5088

8028

11353

9615

14591

13379

11922

12639

10571

11608

12333

Y20

$

Net cash used in investing activities

1414

1266

1604

1610

1175

2175

3012

795

628

1371

549

-3118

1512

2454

1757

2787

9123

13711

3580

11359

13959

3453

2803

2792

Z20

$

Investment in property, plant and equipment

862

1032

1405

1257

1601

2201

2338

1997

1134

1737

1527

1710

1995

2126

1995

2536

3040

2990

3695

4133

4539

3706

3199

3853

AA20

$

Proceeds from sale of property, plant and equipment

163

183

215

291

294

316

333

413

542

420

435

362

353

447

542

556

568

425

495

602

999

617

653

843

AB20

$

Net investment in PPE

=Z21-AA21

=Z22-AA22

AC20

$

Payments for business acquisitions, net of cash acquired

0

411

86

69

-38

22

0

0

166

0

-106

-3557

149

1124

641

855

6793

11248

391

8102

10480

141

167

49

AD20

$

Proceeds from business divestiture, net

0

0

0

0

0

0

0

89

35

448

117

0

0

0

0

0

0

0

0

125

89

87

0

6

AE20

$

Acquisitions minus divestitures

=AC21-AD21

=AC22-AD22

AF20

$

Purchase of assets under capital leases

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

19

0

30

131

122

10

12

3

113

AG20

$

Purchase of assets under financing arrangements

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

57

0

283

0

0

0

0

0

AH20

$

Trade receivables sold

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1700

2800

3510

4241

9627

AI20

$

Comprehensive income

0

0

0

0

0

0

0

0

0

0

3790

3790

356

2737

2737

3457

2620

6237

7337

7715

4478

-14711

6894

2910

AJ20

$

Net investment in PPE and acquisitions

=Z21-AA21

=Z22-AA22

AK20

$

Capex, net PPE + net acquisitions

=AB21+AE21

=AB22+AE22

AL20

$.cc

Net investment in PPE per share

=AB21/Q21

=AB22/Q22

AM20

$

Operating cash flow – net PPE

=X21-AB21

=X22-AB22

AN20

$

Operating cash flow – net PPE – net acquisition costs

=X21-AK21

=X22-AK22

AO20

$.cc

Operating cash flow per share

=X21/Q21

=X22/Q22

AP20

$.cc

Net PPE per share

=AB21/Q21

=AB22/Q22

AQ20

$.cc

Acquisitions minus divestitures per share

=AE21/Q21

=AE22/Q22

AR20

$.cc

Capex, net PPE + net acquisitions, per share

=AP21+AQ21

=AP22+AQ22

AS20

$.cc

Operating cash flow – net PPE, per share

=AO21-AP21

=AO22-AP22

AT20

$.cc

Operating cash flow – net PPE – net acquisitions, per share

=AO21-AR21

=AO22-AR22

AU20

$.cc

Operating cash flow per share (copy)

=AO21

=AO22

AV20

$.cc

Cumulative capex (net PPE + net acquisitions), per share

=AR21

=AV21+AR22

=AV22+AR23

AW20

$.cc

Cumulative Operating cash flow per share

=AO21

=AW21+AO22

=AW22+AO23

AX20

%

Operating margin

=I21/H21

=I22/H22

AY20

%

Net margin

=J21/H21

=J22/H22

AZ20

%

Operating cash flow margin

=X21/H21

=X22/H22

BA20

%

Operating cash flow minus net PPE margin

=AM21/H21

=AM22/H22

BB20

%

Operating cash flow – net PPE – net acquisitions margin

=AN21/H21

=AN22/H22

BC20

$

Increase in Trade receivables sold

0

=AH22-AH21

=AH23-AH22

BD20

$

Cash & cash equivalents

–

641

889

1,357

1,973

2,885

3,072

4,046

5,411

3,415

4,197

11,192

14,188

12,663

13,911

16,400

11,293

10,153

13,279

10,929

8,043

11,301

12,163

15,133

BE20

$

Cash equivalents

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

7,622

10,520

7,561

5,348

8,332

9,039

12,687

BF20

Cash

BF38

$

=BD38-BE38

=BD39-BE39

BG20

$

Cash equivalents + avail-for-sale investments

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

7,815

11,003

8,010

5,910

9,229

9,809

13,404

BH20

$

Available-for-Sale Investments or Securities

–

–

–

–

–

–

–

–

0

328

670

654

585

403

100

78

290

478

474

=BG40-BE40

=BG41-BE41

=BG42-BE42

=BG43-BE43

=BG44-BE44

BI20

$

Cash & cash equivalents + avail-for-sale investments

–

–

–

–

–

–

–

–

=BD29+BH29

=BD30+BH30

=BD31+BH31

=BD32+BH32

=BD33+BH33

=BD34+BH34

=BD35+BH35

=BD36+BH36

=BD37+BH37

=BD38+BH38

=BD39+BH39

=BD40+BH40

=BD41+BH41

=BD42+BH42

=BD43+BH43

=BD44+BH44

BJ20

$

Short-term investments

–

394

755

1,121

643

442

1,497

21

179

592

139

237

403

311

18

22

152

93

55

–

–

–

–

–

BK20

$

Total current liabilities

–

5,094

6,868

8,230

10,944

10,623

11,219

13,473

14,321

15,197

13964

24310

25,469

28,588

31,460

35,850

39,260

52,939

43,003

49,403

50,442

46,666

45,521

43,735

DISCLAIMER: Your investment is your responsibility. It is your responsibility to check all material facts before making an investment decision. All investments involve different degrees of risk. You should be aware of your risk tolerance level and financial situations at all times. Furthermore, you should read all transaction confirmations, monthly, and year-end statements. Read any and all prospectuses carefully before making any investment decisions. You are free at all times to accept or reject all investment recommendations made by the author of this blog. All Advice on this blog is subject to market risk and may result in the entire loss of the reader’s investment. Please understand that any losses are attributed to market forces beyond the control or prediction of the author. As you know, a recommendation, which you are free to accept or reject, is not a guarantee for the successful performance of an investment.